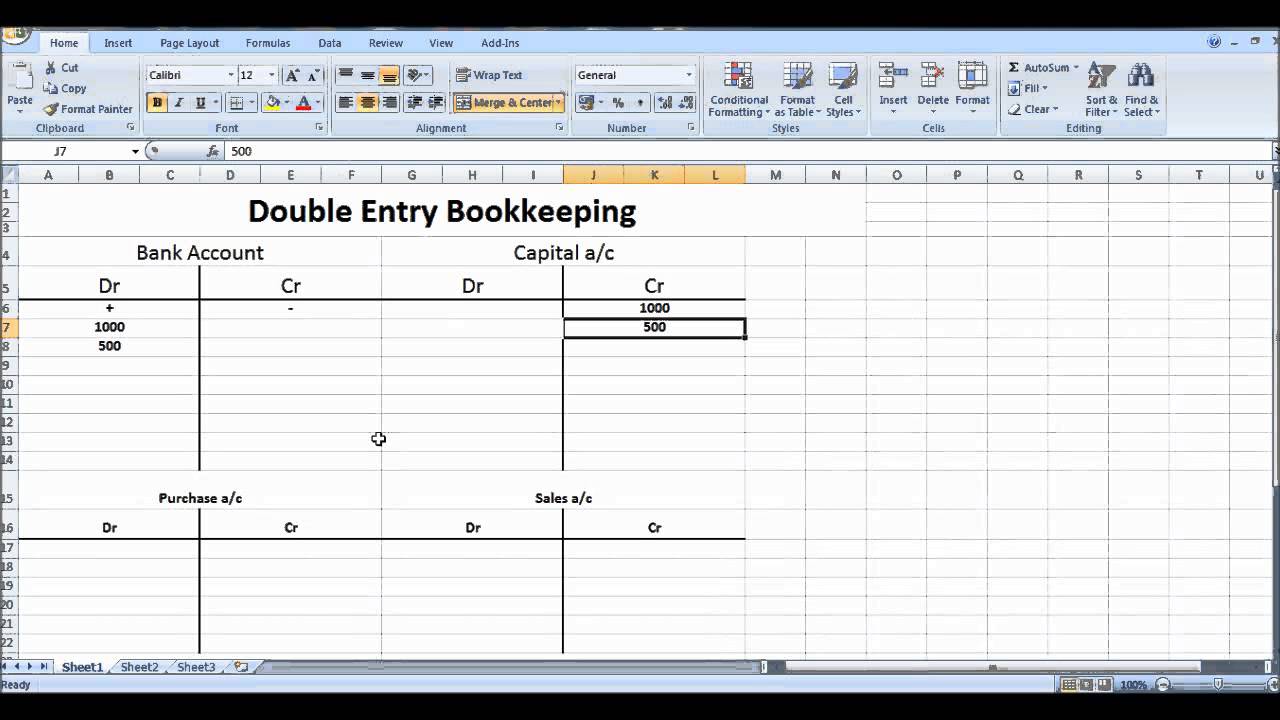

The total amount of debits must always equal the total amount of credits. For example, when a business buys goods worth $500 on credit, it records a debit of $500 in the inventory account (an asset account) and a credit of $500 in the accounts payable account (a liability account). Debit means an increase in assets and a decrease in liabilities, while credit means a decrease in assets and an increase in liabilities. One account is debited, and the other is credited. The double-entry bookkeeping system records every financial transaction in two accounts. Here are the basic principles of double-entry bookkeeping: The system records each transaction in two different accounts: one account is debited, and the other account is credited. This equation represents the resources that a business owns (Assets) and how they are financed (Liabilities and Equity). The double-entry bookkeeping system is based on the fundamental principle that every financial transaction has two equal and opposite effects on the accounting equation, which is Assets = Liabilities + Equity. The Basic Principles of Double-Entry Bookkeeping In this article, we will discuss the basic principles of double-entry bookkeeping and how they work together to ensure accurate financial records. One of the most widely used bookkeeping methods is the double-entry bookkeeping system, which ensures that financial records are accurate and reliable. It is an essential part of accounting, as it helps businesses keep track of their financial health and make informed decisions based on financial data. Bookkeeping is the process of recording financial transactions and organizing them in a systematic manner.

0 kommentar(er)

0 kommentar(er)